The Founder's Essential Guide to SAFE Agreements: From Basics to Advanced Strategies

Your Complete Guide to Startup Fundraising

For those who prefer audio, we’ve transformed this content into speech using NotebookLM. Let’s dive in…

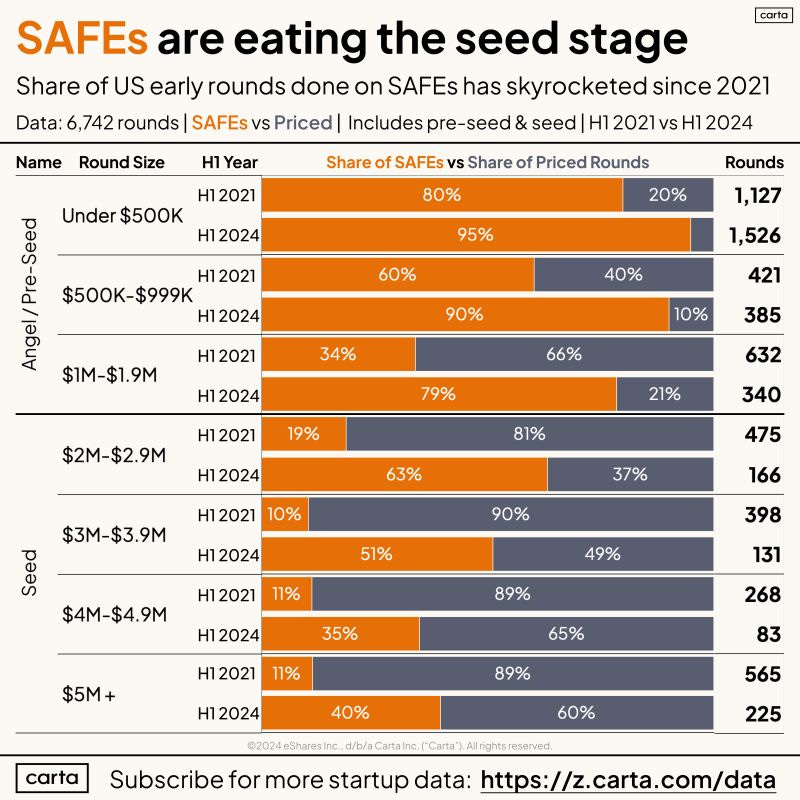

In 2013, Y Combinator introduced a new fundraising instrument that would revolutionize how startups raise early money: the SAFE (Simple Agreement for Future Equity). Today, this five-page document has become the standard way for startups to raise their first rounds of funding. Let's explore why SAFEs have become so popular and how they actually work.

What Is a SAFE?

At its core, a SAFE is a promise between a startup and an investor. The investor provides money now, and in return, the startup promises to give the investor shares in the future when certain events occur, typically when the company raises a priced round of funding. Think of it like a rain check for equity – you're getting a promise today for shares tomorrow.

Why SAFEs Changed the Game

Before SAFEs, startups primarily used convertible notes for early fundraising. While convertible notes served their purpose, they came with two significant complications:

They were debt instruments that accrued interest

They had maturity dates when the debt needed to be repaid

SAFEs eliminated these complications. They're not debt, they don't accrue interest, and they don't have maturity dates. This simplification has made fundraising faster, cheaper, and more founder-friendly.

It’s also widely adopted by nearly all YC startups and has become the go-to tool for early-stage fundraising. Check it out for yourself 👇

The Anatomy of a SAFE

A SAFE document consists of five key sections, each serving a specific purpose:

1. Event Handling

This section explains what happens in three scenarios:

When the company raises a priced round (equity financing)

When the company gets sold (liquidity event)

When the company shuts down (dissolution)

2. Definitions

This section defines all technical terms used in the document. It's like a glossary that ensures everyone understands the terminology the same way.

3. Company Representations

The company makes certain promises to the investor, such as being properly formed and having the authority to issue the SAFE.

4. Investor Representations

The investor makes promises too, such as being an accredited investor and understanding the risks involved.

5. Legal Details

Standard legal language that makes the agreement binding and enforceable.

How SAFEs Convert: A Practical Example

Let's walk through a real-world example of how SAFEs work. Imagine a startup that has raised money from two SAFE investors:

Investor A: $200,000 investment with a $4M post-money valuation cap

Investor B: $800,000 investment with an $8M post-money valuation cap

When the company raises its Series A, here's what happens:

Step 1: SAFE Conversion

Investor A ownership = $200,000 / $4M = 5%

Investor B ownership = $800,000 / $8M = 10% Total SAFE ownership = 15%This means the founders have effectively sold 15% of their company through these SAFEs, even though no shares have changed hands yet.

Step 2: Share Calculation

If the founders originally had 1,000,000 shares, the SAFE investors would receive:

Investor A shares = (1,000,000 × 5%) / (85%) = 58,824 shares

Investor B shares = (1,000,000 × 10%) / (85%) = 117,647 sharesPre-Money vs. Post-Money SAFEs

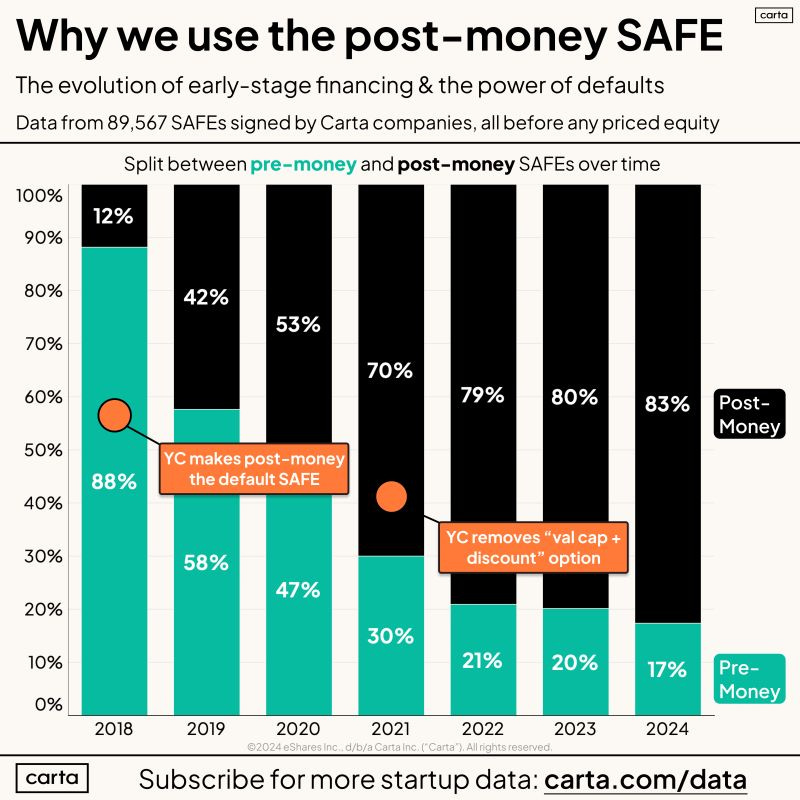

In 2019, Y Combinator updated their SAFE format to use post-money valuations instead of pre-money valuations. This change made it easier for founders to understand exactly how much of their company they were selling.

Pre-Money SAFEs

With pre-money SAFEs, the valuation cap was applied before including the SAFE investment, making it harder to calculate final ownership percentages.

Post-Money SAFEs

With post-money SAFEs, the valuation cap includes the SAFE investment, making ownership calculations straightforward. In our example above, we used post-money SAFEs, which is why we could directly calculate the ownership percentages.

Key Benefits of Using SAFEs

1. Speed and Simplicity

SAFEs can be closed quickly because there are only two main terms to negotiate:

Investment amount

Valuation cap

2. Cost-Effective

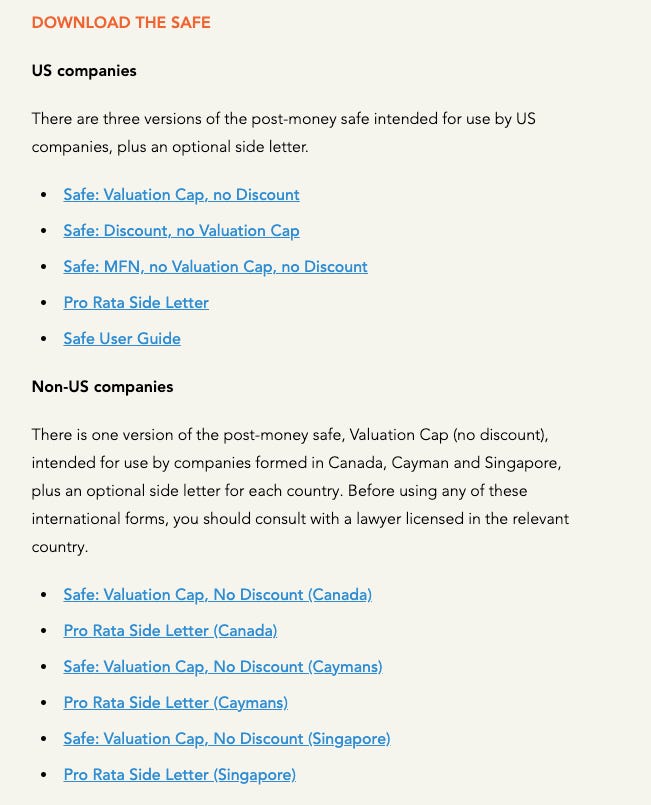

You don't need expensive lawyers to close a SAFE. The standard document is available for free on Y Combinator's website.

3. Founder Control

SAFEs don't give investors:

Board seats

Voting rights

Information rights This means founders maintain control of their company during the early stages.

4. Flexibility

SAFEs convert automatically when you raise a priced round, but you're not obligated to raise a round by any specific date.

Common Variations of SAFEs

While the standard SAFE with a valuation cap is most common, there are other variations:

1. Discount-Only SAFEs

Instead of a valuation cap, these offer a percentage discount on the price of the next round.

2. Most Favored Nation (MFN) SAFEs

These allow investors to adopt the terms of any better SAFEs that the company issues later.

3. Uncapped SAFEs

These have no valuation cap and convert at the price of the next round (rare and not recommended for founders).

Best Practices for Using SAFEs

1. Track Your Dilution

Keep careful track of how much of your company you're selling through SAFEs. Remember that the percentages add up, and you'll need to leave enough equity for future rounds.

2. Use Standard Documents

Stick to the standard Y Combinator SAFE documents whenever possible. They're well understood by the startup ecosystem and designed to be fair to both parties.

3. Understand Your Terms

Make sure you understand exactly what ownership percentage each SAFE represents. With post-money SAFEs, this is straightforward: investment amount divided by valuation cap equals ownership percentage.

4. Plan for Conversion

Remember that SAFEs will convert in your next priced round. Factor this into your negotiations with future investors.

Conclusion

SAFEs have transformed early-stage startup fundraising by making it simpler, faster, and more founder-friendly. Understanding how they work is crucial for any founder planning to raise money. While they might seem complex at first, their standardization and clear structure make them a powerful tool for getting your startup funded.

The key is to remember that while SAFes make fundraising easier, they still represent a serious commitment to give up future equity in your company. Use them wisely, keep track of your commitments, and make sure you understand exactly how much of your company you're promising to future investors.

Resource

Hi, it’s Yuann and Kevin from The Curiosity Insights.

At The Curiosity Insights, we blend expertise in business strategy, design, and emerging fields like Web3 and AI to empower entrepreneurs, investors, and business leaders to navigate the fast-paced world of technology and innovation. We help our clients overcome challenges and confidently seize growth opportunities.

With bases in the EU and Taiwan, and a network spanning Southeast Asia and the US, we bridge perspectives from East to West. Our mission is to connect valuable insights and talent worldwide, providing the clarity and strategic edge needed to thrive in today’s interconnected market.

Why Partner with The Curiosity Insights?

Strategic Scouting & Market Research: Uncover hidden opportunities and emerging trends through our deep market intelligence, tailored to keep you ahead of industry shifts.

Innovation-Driven Insights: Utilize our specialized expertise in AI, Web3, and other transformative technologies to accelerate growth, stay competitive, and lead in your market.

Comprehensive Solutions: From exploring breakthrough technologies to evaluating high-potential investments, we offer a full range of support to propel your business forward at every stage.

Ready to unlock new possibilities? Let’s explore how emerging technologies and strategic insights can elevate your business. Reach out today to start your journey with The Curiosity Insights – where the future meets action.