Today’s article will take a fresh approach compared to previous ones. As our reader base grows bigger, it’s the perfect moment to rethink how I can deliver even more value, especially in the area of growth strategies.

One key metric that plays a pivotal role in your product’s growth is retention—tracking whether users consistently return to engage with your features or product.

Retention not only reveals how well your product resonates with users but also directly impacts your growth potential. A product with strong retention demonstrates that users find ongoing value, while poor retention could signal deeper issues with user experience or product-market fit. In this article, I’ll dive deeper into why retention is critical, how to measure it effectively, and what strategies can help you improve it to ensure sustained growth.

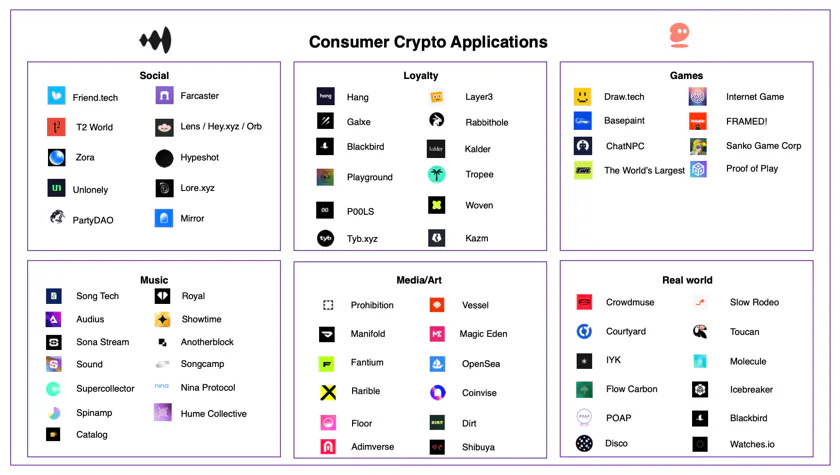

Now, I believe this is a great time to build more crypto consumer apps. The infrastructure of blockchain is maturing, L2 solutions have reduced gas fees, and wallets have become more user-friendly. We are in the early stages of creating something that delivers value and provides a great user experience.

In the world of crypto, building hype and excitement within the community is easy. However, sustaining that momentum over the long term requires more than just buzz—you need a strong mechanism to retain your users. This is why retention is crucial to the success of any crypto product.

To understand what drives retention, let’s first examine the most common reasons users churn:

Failure to deliver on fundamental value: If users don’t see immediate or sustained value, they’re unlikely to stay.

Poor first-time experience: A complex or confusing onboarding process can turn users away before they’ve even begun.

Lack of stickiness: Your product must continuously remind and re-engage users to bring them back.

Overwhelming navigation: A cluttered or confusing interface frustrates users and encourages them to leave.

Technical issues or slow performance: In the fast-paced world of crypto, performance issues can easily drive users away.ed a framework for retention in crypto consumer apps, focusing on three key areas:

To address these issues, I’ve developed a framework for retention in crypto consumer apps, focusing on three key areas:

Value Delivery: The product must consistently provide clear and tangible value. This could be financial gains, unique access, or utility that aligns with your users' needs. For crypto apps, this means ensuring that users see real benefits from engaging with your platform—whether through better returns, lower fees, or unique offerings.

User Experience: The experience must be intuitive and frictionless. Streamlining the onboarding process, reducing the complexity of wallet setups, and improving the ease of use are critical. In crypto, where technical barriers are often higher, making the journey as smooth as possible will help improve retention.

Tech Reliability: Your crypto app must be fast, reliable, and free from errors. Network congestion, slow transaction times, or high gas fees are common frustrations in blockchain-based products. Ensuring your picking the right ecosystem for reliability will keep users from dropping off due to frustration.

Value Delivery: Being Significantly Better than Alternatives

To retain users, your product must not only provide clear value but also be significantly better than the alternatives.

As Peiris emphasizes, for a product to benefit from organic growth and word of mouth, it needs to be “an order of magnitude better than the alternative.”

This means offering a unique experience that users didn’t realize was possible—like instant international money transfers that set a new standard in the market.

For example, when Wise (formerly TransferWise) entered new markets, they discovered that being only slightly cheaper than competitors (e.g., 5.8% vs. 6% in fees) wasn’t enough to drive significant growth. It wasn’t until they became substantially better than the incumbents that they began to see explosive, hockey stick growth.

The ultimate question to evaluate your product’s value is: “How would you feel if you could no longer use this product?” If 40% or more of users would be “very disappointed” without it, this is a strong indicator of product-market fit.

This metric shows that your product has become indispensable to your users, which is key to achieving strong retention and long-term success.

By delivering a value proposition that clearly exceeds alternatives and fosters a sense of necessity, you can ensure that your users continue to engage with your product, building a loyal user base.

User Experience: Progress, Challenges, and the Future

The user experience (UX) in crypto apps has made significant strides in recent years. Improvements like Coinbase Smart Wallet and Zora’s double-tap to mint have brought crypto apps closer to the seamless, intuitive feel of mainstream Web2 applications. Some consumer-facing crypto apps are even beginning to offer experiences comparable to those found in traditional tech. However, despite this progress, there’s still a considerable gap between crypto apps and Web2 counterparts in terms of UX.

Crypto apps currently exist on a spectrum: at one end are easy-to-use apps that haven’t yet nailed their core utility, and at the other, more complex apps that users tolerate only for the potential financial gain. To truly enhance user retention, it’s critical that these apps balance both ease of use and functionality.

A key area for improvement lies in interoperability and seamless experiences. Crypto has the potential to offer interconnectedness between apps and services, allowing users to perform actions across multiple platforms without repetitive setups. For example, users should be able to follow someone on one platform and have that action carry over to other apps seamlessly. This level of integration could be a game changer, providing a competitive advantage that traditional Web2 platforms can’t easily replicate.

In striking a balance between familiarity and innovation, crypto apps should adopt familiar design patterns to provide user comfort (e.g., a shopping cart in the top right corner), while also pushing the boundaries of how blockchain can transform digital experiences. Early crypto adopters have shown a high tolerance for rough or less-polished user interfaces, but as the industry matures, delivering on value over polish will remain key. As long as a crypto app offers unique value—such as decentralized features or financial opportunities—users may overlook a less refined interface during its early stages.

Looking ahead, decentralized social graphs present an exciting opportunity for the future of crypto UX. Platforms like Farcaster are not just social networks but databases of connections that can be leveraged across the entire internet. This could lead to personalized and interconnected experiences where a user’s activity on one platform enhances their experience across others. Imagine being able to follow someone on an e-commerce platform or access relevant restaurant reviews from trusted connections—all powered by decentralized social graphs.

As UX continues to improve and crypto apps evolve to offer both utility and ease of use, we’re moving closer to mainstream adoption. The technical infrastructure has already advanced, making tools cleaner, more accessible, and more user-friendly. As crypto consumer apps continue to mature, the key to long-term retention will be offering engaging, intuitive, and seamless experiences that go beyond what’s possible in Web2.

Tech Reliability: Scaling, Security, and Interoperability

As crypto infrastructure continues to evolve, tech reliability is crucial for ensuring long-term growth and user retention. From scaling solutions to improving wallet security, technological advancements are laying the foundation for a more resilient and user-friendly ecosystem.

One significant player in this space is Base, which aims to become the largest Layer 2 (L2) economic zone. While it’s already leading in various activity metrics, Base recognizes that scaling is critical to future success. Their goal is to achieve 1 giga-gas per second throughput within the next 12-24 months, a 400x increase from their current capacity. They plan to achieve this largely through optimizations within the existing Ethereum Virtual Machine (EVM), such as just-in-time optimistic parallelization and changes to state root calculation methods. Beyond this, Base envisions a future with thousands of Layer 3 (L3) solutions built on top of L2s, each tailored for specific applications and varying levels of decentralization.

Interoperability between L2 solutions is another key aspect of tech reliability. Jesse Pollak highlights the importance of asset fungibility—the ability to seamlessly move assets across different L2s without introducing additional trust assumptions. While current solutions like bridges (e.g., Axelar) add extra layers of complexity and potential fragility, the goal is to create an ecosystem where assets, such as Optimism’s OP token, can move freely across Base, Optimism, and other L2s with consistent trust assumptions.

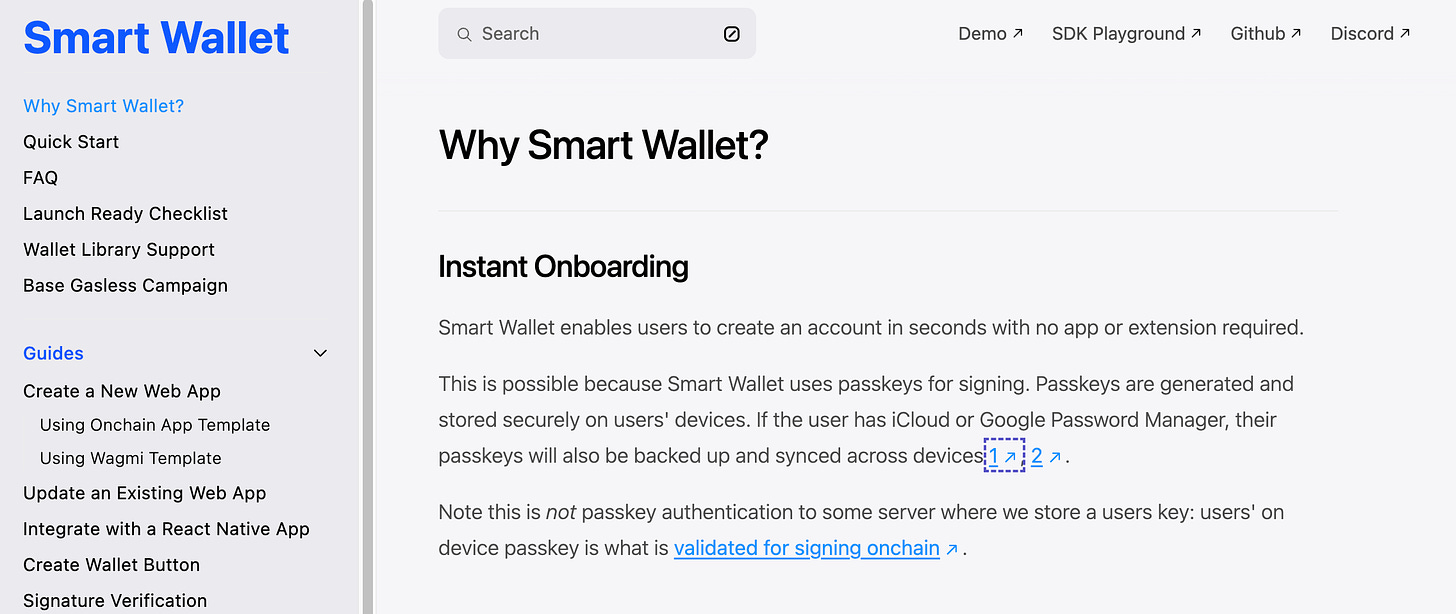

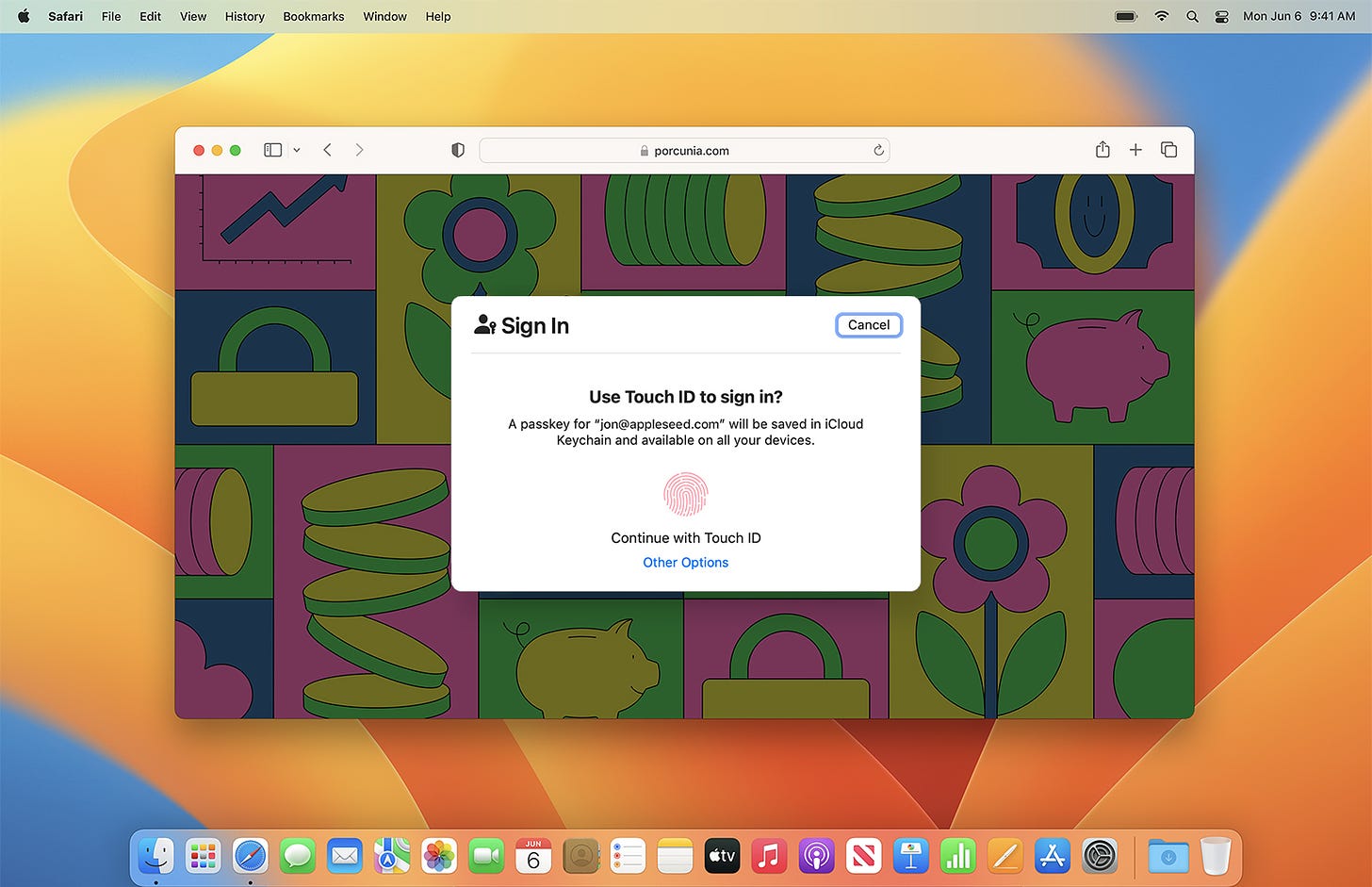

Security and ease of use have also taken major steps forward, particularly with the development of Coinbase’s new smart wallet technology. Unlike traditional crypto wallets that require users to back up seed phrases, smart wallets eliminate this step by using passkey technology.

Passkeys, developed by tech giants like Apple, Google, and Microsoft, store the private key in the device’s secure enclave and automatically back it up to the cloud in encrypted form. This not only simplifies the onboarding process but also significantly reduces the risk of losing access to funds due to lost seed phrases. Additionally, smart wallets integrate with existing Coinbase accounts, allowing for seamless transfers between on-chain and off-chain assets—a feature called Magic Spend.

The emphasis on scalability, security, and interoperability ensures that crypto platforms can handle increasing demand while offering secure, seamless experiences for users. As these technologies continue to improve, crypto products will become more reliable and user-friendly, paving the way for broader mainstream adoption.

Summary

User engagement is the cornerstone of successful crypto apps, setting them apart from those that fail. Engagement thrives on delivering real value, solving user problems, and offering a seamless, personalized experience. Developers must prioritize understanding their market and user base from the earliest stages of development, while focusing on retention strategies to keep users engaged long after they install the app.

By embracing user feedback, tracking key metrics, and iterating on the product, developers can ensure their app’s success in the dynamic crypto space. Building user-centric, value-driven applications that leverage blockchain’s unique properties—reducing friction, enhancing interoperability, and exploring novel use cases—will lead to broader adoption and more engaging experiences.

Hi, I'm Kevin!

My goal is simple: to make cutting-edge technologies accessible to everyone. Whether you're looking to expand your knowledge or apply these insights to your personal growth, I'm here to guide you through the exciting worlds of web3 and AI.

Why Choose Curiosity Insights?

We offer:

Cutting-edge Analysis: Our team of experts dissects the latest developments in AI and Web3, providing you with actionable insights.

Strategic Advantage: Stay ahead of the curve and make informed decisions that drive innovation and growth.

Comprehensive Coverage: From investment opportunities to technological breakthroughs, we've got you covered.