Bonding Curve

Using a mathematically-based approach is an effective way to incentivize new adopters, especially in a crowded market. Here's what I've discovered.

Hello! Kevin Wang here. I'm a devoted product manager by day, but come evening, I'm the force behind a Gen-AI Tool - tulsk.io. My mission? To fuel your venture, guide you through the startup world, spotlighting user experience, product management, and growth strategies, particularly in the web3 and AI spaces. Keen to dive deeper? Join the tulsk.io community. Your support is invaluable and ensures I can share insights for budding entrepreneurs like you. Let's journey together!

In my research into technical tools for expanding the network effect in NFT marketplaces, I was surprised to learn that I'm somewhat behind the curve. Many protocols to tackle liquidity challenges and significantly boost buying interest in specific digital assets. Therefore, I'm here to share with you the fundamental principles of the Bonding Curve, including why it exists, how it functions, and some captivating design questions you might consider if you're thinking of leveraging it as an automation tool to augment sales.

The original concept of Bonding Curves, also known as Continuous Tokens or Smart Tokens, was developed between 2016 and 2017 by Bancor and Simon de la Rouviere.

What’s Bonding Curve?

Based on CoinMarketCap’s definition, A bonding curve is a mathematical curve that defines the relationship between the price and the supply of a given asset.

Why It Exists?

Smart contracts implement bonding curves to facilitate the seamless exchange of assets. A common formula used in these curves is “X * Y = K”, where the 'Invariant K' plays a crucial role in setting the exchange rates between tokens X and Y. This relationship showcases how prices dynamically adjust as the supply of either token changes.

Bonding curves thus provide a predictable pricing mechanism that operates automatically, diminishing the reliance on intermediaries. They ensure liquidity and can offer incentives for early adopters.

Upon closer examination, the versatility of bonding curves becomes apparent, rendering them adaptable to diverse scenarios and configurations. They play a pivotal role in laying the groundwork for projects entrenched in a token-centric economic framework. Here are some questions you may consider.

What are the benefits of using a Bonding Curve?

Are there different types of Bonding Curves?

Are there customizable Bonding Curves?

Are there risks and challenges associated with Bonding Curves?

What are the benefits of using a Bonding Curve?

The benefits of utilizing a Bonding Curve in token economies are

Liquidity: Bonding curves are designed to ensure that a token always has liquidity. Since the price of the token is determined by the curve itself, users can always buy or sell the token at a price set by the curve, without needing another party to match the trade.

Price Discovery: The curve provides an automated mechanism for price determination based on supply and demand. As more tokens are minted (bought), the price increases, and as tokens are burned (sold), the price decreases.

Incentivization: Early participants in a token economy using a bonding curve can be incentivized through lower initial prices. This can encourage early adoption and participation, which is crucial for the network effect in a new ecosystem.

Predictability: The formulaic approach to pricing through bonding curves provides predictability in how the price of a token will change as more tokens are bought or sold. This can help users make more informed decisions about when to participate.

Funding and Value Capture: For projects that issue tokens through a bonding curve, it can be a mechanism to fundraise and capture value. As demand for the token increases, the value captured by the curve (often in the form of a reserve) increases.

Automated Market Making: Bonding curves act as automated market makers, allowing continuous and autonomous token trading without the need for traditional market makers or order books.

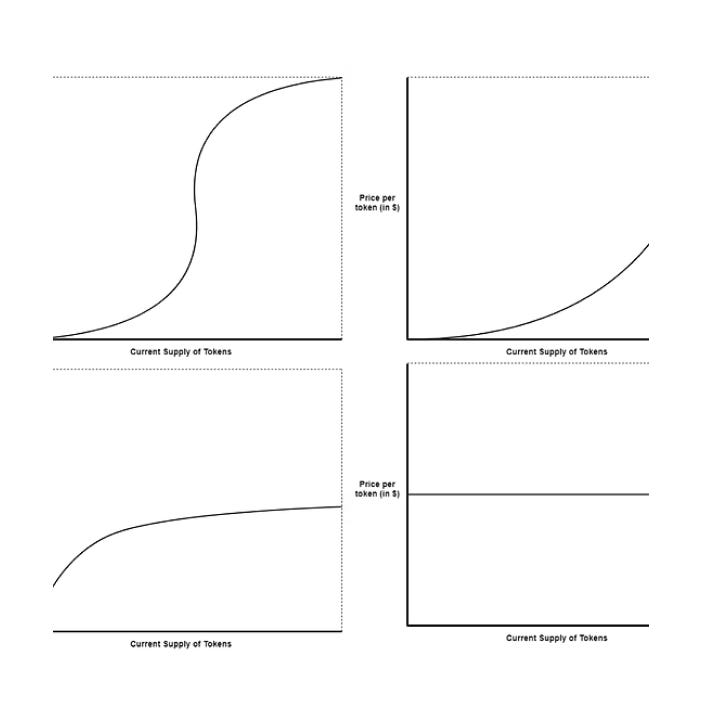

Are there different types of Bonding Curves?

Developer note: Implementing complex mathematical formulas in Solidity can be gas-intensive and may quickly become highly complicated. If you're considering the implementation of an intricate curve, I recommend exploring Vyper as an alternative.

Sigmoid Curve Application:

This curve aims to amply reward early adopters who predict the meme's success, marked by a steep price increase at the supply curve's inflection point. Early investors gain more, while those hopping on the bandwagon after the meme hits mainstream—post-inflection point—receive lesser rewards. The design of the Sigmoid curve is to substantially favor the initial investors and apply higher costs to later ones.

Negative Exponential Curve Scenario:

Imagine you're initiating a crowdfunding venture akin to Kickstarter. Your goal is to incentivize early backers without significantly disadvantaging latecomers. A negative exponential curve serves this purpose well. It's crafted to reward early contributions more generously, without harshly discouraging later investments.

Quadratic Curve Scenario:

This encourages early participation and fair distribution, as accumulating large amounts of governance power becomes increasingly expensive. It prevents wealth concentration and ensures a democratic approach to governance, as the cost to influence the DAO becomes prohibitively expensive quickly.

Linear (Non-Increasing) Curve Scenario:

To maintain its peg and encourage trust in the early stages, it will adopt a linear non-increasing curve for minting the stablecoin. The issuance price starts high to control early circulation and gradually decreases linearly as adoption grows, avoiding sudden price changes. This can help stabilize the coin's value and encourage its use as a reliable medium of exchange or store of value in the crypto economy.

Are there customizable Bonding Curves?

Bonding curves are highly versatile and can be tailored for various applications, including Uncapped Markets and Taxation Strategies.

Here’s a closer look at how these work:

Uncapped Markets Explained:

In scenarios like an uncapped market, the idea is that there isn't a fixed limit on how many tokens can be created. This is particularly useful in situations where it's hard to predict how much demand there will be. Take a lottery system as an example, where each ticket is a token. In such a case, you wouldn't want to limit the number of tickets because you can't foresee how many people will want to buy them. An uncapped or capless bonding curve allows for the creation of as many tokens as needed, responding to demand in real time. This means that if more people want to join the lottery, the system can create more tickets without running into a pre-set limit. This flexibility is key in markets or events where demand can vary significantly and is hard to estimate beforehand.

Taxation Strategies Explained:

When it comes to using bonding curves for fundraising purposes, how money is collected and managed becomes vital. Here, taxation strategies come into play.

Buy Tax: This involves taking a small portion of the money paid (collateral) for each token purchase and moving it to a separate fund, which could be another contract or a wallet. This is particularly useful for fundraising because it allows the project to raise money every time someone buys a token. The key advantage here is that this method raises funds without decreasing the value of the tokens that are already circulating among users.

Sell Tax: This is the opposite - a fee is charged when someone sells their tokens. The fee collected from these transactions can then be used for various purposes, such as supporting the project or providing liquidity. This approach can discourage the quick selling (or flipping) of tokens and promote more stable, long-term holding.

Tax on Both Purchases and Sales: Some projects might choose to apply taxes on both buying and selling. This can create a balanced system where both entry and exit in the market are taxed. It can be a way to ensure that the project continuously raises funds and can also be used to stabilize the token economy.

Each of these strategies has different implications for how a project is funded and how the token market behaves. Choosing the right strategy depends on the project's goals, the behavior they want to encourage among token holders, and how they plan to sustain the project financially.

Are there risks and challenges associated with Bonding Curves?

Early Adopter Advantage: Early adopters can hold a large portion of the supply indefinitely at a cheaper price, creating a disparity with late adopters.

Sybil Attacks: There's a risk of Sybil attacks where an individual spreads tokens across multiple addresses to manipulate the bonding curve.

Incentivization and Disincentivization: The dynamic bonding curves incentivize new adopters to hold tokens and penalize inactive adopters, as the value of their tokens reduces over time. This helps in ensuring a wide distribution of token supply.

Community Token Application: In community tokens, dynamic bonding curves can incentivize new members and disincentivize free riders. However, this requires careful governance to ensure fair distribution and contribution recognition.

Preventing Network Attacks: Measures need to be in place to prevent whales from buying large portions of the supply and to discourage Sybil attacks.

For an in-depth exploration of this topic, you might find the article "Dynamic Token Bonding Curves" particularly insightful.

Conclusion

I'm extremely excited to learn about the many brilliant minds behind the Bonding Curve mechanism. Using a mathematically-based approach is an effective way to incentivize new adopters, especially in a crowded market. While I firmly believe that user experience is the cornerstone of a product's success, integrating the Bonding Curve mechanism can facilitate more organic growth. If you're keen on understanding the calculations behind it, I recommend reading the article, "Bonding Curves - The What, Why, and Shapes Behind It."

Reference:

Exploring Bonding Curves: Differentiating Primary and Secondary Automated Market Makers

Incentivising participation and growth in communities (using crypto-economics)

🌟 Spread the Curiosity! 🌟

Enjoyed "Curiosity Ashes"? Help ignite a wave of innovation and discovery by sharing this publication with your network. Let's foster a community where knowledge is celebrated and shared. Hit the share button now!